onCourse documentation copyright ish group. Licensed under CC BY 4.0. You are free to, share and adapt this documentation for any purpose, as long as you give appropriate credit.

I: Basic concepts

onCourse is the ERP system for providers of education and events. Integrate with everything and automate your manual processes. Create beautiful websites. Accounting. Document management. Learning management. Tutor wrangling. Student untangling. Government compliance reporting. ecommerce and so much more.

To search for anything in this manual, please use your browser search function. CMD+F on Apple based machines or CTRL+F on Windows machines.

1. onCourse set up

If you install onCourse yourself, rather than using the managed service from ish, you’ll need to configure the environment into which you install onCourse. You will need:

-

A unix, linux, OSX or Windows operating system

-

A database. No database specific features are used, but onCourse is regularly tested with MariaDB, MySQL, and Amazon Aurora RDS. Others like postgresql or SQL Server might also work, but aren’t regularly tested.

-

An outbound mail server (smtp)

-

Java 11 or higher

1.1. Installing dependencies

On MacOS, use homebrew to install many of the requirements.

-

Install MariaDB 10.4.

brew install mariadb@10.4 -

Install Java. ` brew tap homebrew/cask-versions; brew install temurin11`

Now set up your database.

-

brew services start mariadbto start the server -

mysql_secure_installationand configure the root account. -

mysql -uroot -pto log in to the SQL console and execute some commands to create a user. Use a proper secure password instead of 'password123'.CREATE USER 'onCourse' IDENTIFIED BY 'password123'; GRANT ALL PRIVILEGES ON * . * TO 'onCourse'; FLUSH PRIVILEGES;

CREATE DATABASE onCourse; exit;

2. Installing onCourse on your server

Download onCourse Server. There is one application bundle which will work on OSX, Windows, Linux and Unix platforms. Unzip it to any suitable folder.

onCourse is happy in a virtualised environment such as VMWare, Xen, or AWS EC2. Ensure that you have sufficient RAM and CPU allocated. onCourse Server only writes to disk for log files, so memory and CPU are more important than disk performance. Allocate at least 400Mb of RAM, but at least 1Gb is better. onCourse will take all the memory you give it to cache data and run faster, up to a point.

2.1. onCourse.yml

The bundled onCourse.yml looks like this:

http:

port: 443

ip: 127.0.0.1

path: /

db:

uri: 'jdbc:mariadb://127.0.0.1/onCourse?user=onCourse&password=password123'

license:

max_concurrent_users: 99

custom_scripts: True

access_control: True

smtp:

email_batch: 100000

host: smtp.gmail.com

port: 465

mode: tls

username: your_email@gmail.com

password: your_email_password

monitoring:

user: monitoring

password: password123At a minimum, you’ll want to set the ip address to a reachable address on your server. Perhaps you’ll have onCourse behind a firewall or load balancer or exposed directly to the internet on a public IP address. That’s up to you. In order to run onCourse on a port lower than 1024 you will typically need to run it as root. Remember that onCourse includes functionality to write scripts which can then access the entire system as the user the server is running as, so where possible run onCourse as a non-privileged user or run it in a jail.

The database connection should be configured appropriately. The mariadb JDBC driver should work fine with mysql or AWS Aurora, but if you want to use Microsoft SQL server you’ll need to add the jtds library to your classpath.

The license section allows you to limit concurrent users and disable some functionality of the product. The smtp mode can be one of:

-

tls

-

starttls

-

unsafe

Use 'unsafe' only if you are sure you want to send unencrypted mail across your network or the internet. That’s usually a bad thing. If you want to use gmail to send outbound mail, you’ll need to provide a valid username and password here, and also relax security settings here. Otherwise you can use your ISP’s mail server, your office server or an MTA like exim you install locally.

By setting a monitoring username and password you can monitor the server at the URL path /monitoring. A json response will be returned with the following fields:

{

"time": {

"current": 1649163079287,

"timezone": "Australia/Sydney",

"iso8601": "2022-04-05T12:51:19.287716Z",

"uptime": 89189

},

"network": {

"path": "/",

"port": 8182,

"ip": "127.0.0.1"

},

"environment": {

"java.version": "11.0.14",

"os.arch": "x86_64",

"java.vm.specification.name": "Java Virtual Machine Specification",

"java.vm.vendor": "Amazon.com Inc.",

"os.version": "12.1",

"java.vm.specification.vendor": "Oracle Corporation",

"java.vm.info": "mixed mode",

"java.vendor": "Amazon.com Inc.",

"java.vm.version": "11.0.14+9-LTS",

"os.name": "Mac OS X",

"java.vm.specification.version": "11",

"java.vm.name": "OpenJDK 64-Bit Server VM"

},

"license": {

"access_control": true,

"users.max": 99,

"college_key": "1234",

"users.current": 0,

"custom_scripts": true

},

"systemRuntime": {

"heap.used": 218615712,

"cpu.usage": 0,

"availableProcessors": 6,

"heap.total": 447741952,

"threads": 43

},

"onCourse": {

"version": "120.1234"

}

}

2.2. Invite new users

To create the first user or to reset passwords if you have lost them, create a file called createAdminUsers.txt and put it in the same folder as onCourse.yml. That file should contain one line per user in the format:

firstName lastName email

Put spaces between the fields. When you restart onCourse this file will be deleted and those users will be sent an invite link by email.

2.3. SSL Certificate

When onCourse first starts, it will create a self-signed SSL certificate in a file onCourseSSL.pem. This will ensure all traffic to onCourse is encrypted but if you want to remove browser warnings that you’ll get with a self-signed certificate you should replace onCourseSSL.pem with a certificate signed by a trusted authority.

2.4. Launching server

Run onCourse using either the bin/server.bat Windows script file or bin/server for all other platforms.

Once it is running, you should be able to connect with your browser. Make sure you use https, any special port you’ve chosen and your browser will need to support HTTP/2.

2.5. Memory allocation

Edit the value of DEFAULT_JVM_OPTS in the bin/server or bin/server.bat. The parameter -Xmx specifies the largest amount of heap memory allocated to the application. Java will allocate a bit more than this for compiling code and running the JVM itself. It is very important that you don’t allocate more memory than the machine actually has available or else everything will run incredibly slowly as the operating system swaps to disk.

More memory generally helps onCourse run faster.

2.6. Log files

onCourse will create a logSetup.xml file in the same directory as onCourse.yml when it starts up. This is a standard log4j2 configuration file and you have full access to all the configuration of how logs are output, rolled over and the logging levels.

By default logs are output to a folder called 'logs' in the same directory as the application.

2.7. Upgrading onCourse

Shut down the server and replace all the application files. It is important to completely delete the old lib folder and remove old files; don’t just keeping adding the new ones. Really the only file you need to keep between releases is onCourse.yml.

3. Getting Started

3.1. Welcome to ish onCourse

Welcome to ish onCourse.

To help you use onCourse comfortably, this section will demonstrate the various windows, lists, records and other icons you’ll see. onCourse is designed to be flexible and easy to use, and you can have it set up to help you complete your tasks.

onCourse is customisable, so you can tweak the windows and layout for your own use. onCourse will open using the last layout used as your preference the next time you open it.

3.2. The onCourse Dashboard

The dashboard is the opening window of onCourse; it is the first thing you will see on your screen after you successfully login. The dashboard is made up of a three-column view window with a collapsible, global navigation quick access column containing favourites, categories & latest activity. Enrolments, revenue and automation status live in the middle, and onCourse news on the right. There is also a logout button, a button to change your visual themes and, in some cases, an Upgrade to onCourse Pro button for anyone using the free version of the software.

Columns can be resized by hovering your mouse over one of the cut-off lines, then clicking and dragging either left or right to decrease or increase the size of the column. You can also resize the browser window by hovering your mouse over the bottom-right corner, or the left or bottom edges of the window, then clicking and dragging to resize it.

The global navigation column can be collapsed by clicking the x in the top-left.

Global Navigation

This is the left most column that appears on the dashboard. This column can also be accessed in numerous other windows in onCourse, allowing you to quickly access any part of the application in just a few clicks. Click the burger icon in the top left to display the column if it’s hidden. Click the x to collapse it.

Favorites

Favourites is the best way to gain one-click access to almost all the different areas of the application.

Initially, Favorites will only show Checkout. Click into a category and select the heart icon that appears when hovering your mouse over a selection to add that window to your favourites.

Your favourites will always appear at the top of the global navigation, and it will always contain Checkout.

Categories

Each window in onCourse is grouped by category to better give users an idea of what can be achieved in onCourse. Some windows may appear in multiple categories.

Click on a category to expand it. You’ll see a full description for each category, as well as descriptions for each section in onCourse.

The categories are:

-

Scheduling

-

Automation

-

Accounting

-

Sales

-

Configuration

-

Accreditation & RTO

-

Help

-

Marketing

-

Education

-

Payroll

-

Document Management

-

CRM (Customer Relationship Management)

Latest Activity

This section appears below the categories. It will save and then display a history of the most recent records you’ve interacted with, including during previous logins, acting as a quick way to revisit screens you were just using. You can click any of the displayed windows or records to go directly to it.

Automation Status

This section shows you whether your most recent automation tasks were successful in executing or not. It will only show to users with a user role that allows the viewing of audit logging.

Hover your mouse over a tick or cross icon to learn the time of execution (or failure), or click the ellipsis (…) to see the audit logs for that script.

On Demand Automations/Scripts (Admin only)

On Demands Automations appear only for admin users, and can be triggered manually from the Automation category on the Dashboard. They will appear here when three conditions are met:

-

The script is set as on demand

-

The script has no related entity

-

The script is enabled

You can learn more about automation scripts in general by going to our Automations chapter.

Find anything

At the top of the Dashboard, you’ll find a powerful search box called Find Anything. Here you can find all manner of data in onCourse and have it accessible at your finger tips with only a few keystrokes. Simply type in what you’re looking for, be it a contact’s last name, a course code or even an invoice number and the search results should populate as you type, filling out with any matching result. You can also search contacts using email address or phone number.

The results should in order of newest to oldest record. It will only show a small handful of results at first. Click 'View more' to see the full list.

Feel free to experiment with what you can search for, it covers a lot of data!

Enrolments & Revenue

This column will give you a simple, graphical representation of your recent enrolments and revenue from the past four weeks in an easy-to-read graph. As well as the visual graph, you’ll also see the raw numbers of enrolments and revenue, as well as a breakdown of the number of courses you have set up in the system.

The course breakdown will show you the last courses enrolled in, the courses with the highest number of people on a waiting list, the number of courses open for enrolment, and a detailed look at the number of courses currently classed as in development, cancelled, commenced and completed.

|

This can be hidden from other onCourse users by turning off their Invoice view permissions in User Roles |

onCourse News

This section shows the latest posts in the onCourse blog, and will also be updated with news about everything onCourse.

Themes & Log Out

In the top-right of the Dashboard there are two new icons, Themes and Log Out. Log Out is self-explanatory, click this to log yourself out of the system and return to the main login page.

Themes will allow you to select a visual theme for the application from those that are currently available, Light, Dark & Monochrome. This setting is saved for each user, so if multiple users use onCourse on the same computer, it will remember their preferred setting.

The current available themes are:

- Light

-

the standard orange & tan theme you see throughout most of the screenshots in this manual.

- Dark

-

A dark background with light fonts

- Monochrome

-

A light theme that’s mostly while backgrounds with dark text

- High Contrast

-

Similar to Monochrome except makes more use of darker titles and some backgrounds.

3.3. Contact Insights

One of onCourse’s CRM features is the contact insight panel that displays when searching for a contact, student or tutor from the global navigation.

When you type something that returns a contact search result in the find anything search, clicking a result will open up that contact in the contact insights panel, showing an overview and a timeline of their recorded actions within your onCourse system.

|

If you want to continue on to the contact record, click the shortcut icon to the right of the contacts name when the insight panel opens. |

The Overview shows the dollar amount they’ve spent with you, any amounts owing, the number of enrolments, applications and leads they have recorded against their contact, and their activity timeline.

Click any item in the timeline except Notes to review the activity. Hovering your mouse will show the shortcut icon next to the item. You can click the activity or the shortcut to be taken to its applicable record.

Add a note to the timeline (and the contact record) by using the note field at the top of the activity timeline.

You can also reach the contact insight panel or a contact whenever you see the waving person icon, as shown below.

3.4. List View

onCourse’s list views appear when you open a window. For example, if you click on Classes on the home screen a list view will be opened showing a list of the current classes in onCourse.

By default, this list is filtered to hide classes that are completed or cancelled. You can change this using the core filters on the left.

List views will display columns relevant to the window you’ve opened. Select a record by clicking on it, or select multiple records by holding shift (or cmd on Mac) and clicking on each.

Add new records by clicking the + button.

Column size can be adjusted by clicking and dragging the edges of a column from side to side. You can also customise the columns that appear by clicking the 'eye' icon and selecting your preferred columns.

Filters can be applied in the left-side column. Learn more about creating filters using tags in our Tagging chapter.

You can sort columns by clicking their header. You can sort by multiple columns by holding down the shift key and clicking each column. The sort will prioritise based on the order of the columns you click. List views offer a two-column and three-column view.

You can also sort the tag groups in the left column by clicking and dragging the group heading and moving it up or down the column, then dropping it in the position you want.

The three-column view will give you a detailed look at a specific record, while the two-column view will give you a better overview of more data.

Advanced Search will let you find records using a combination of conditions. You can learn more about Advanced Query Language (AQL).

Within the two-column view you can customise the columns visible to you by clicking the eye icon that appears, and then selecting the columns you want to be visible.

Help icon

This circular question mark icon can be found all throughout onCourse, and when clicked, will give you the choice of opening up the user manual to the relevant location, or to view the audit logs.

Searching in List Views

Advanced and simple searches are also available from the list view, and all record printing or exporting happens from the list view. You can learn more about Searching here.

Adding and removing records in List View

The list view is also where you can add and delete records. On most list views, you will see a plus + to create records. Click on the plus symbol to create a new record and fill out the fields and options fulfill the criteria needed for that particular record.

To delete a record, highlight the record you want to remove, click on the cogwheel, and select 'Delete record'.

Some records in onCourse cannot be deleted because they have formed relationships with other onCourse records, and it doesn’t make sense to be allowed to delete half of a record relationship. E.G. if you try to delete a class with one or more enrolments in it (even if those enrolments have been cancelled), you will get a message like the one below. In this instance, you would need to cancel the class instead of deleting it.

However, if you tried to delete a class without any enrolments, you will see a message like the one below. Once you select 'delete' the record will be permanently removed from the database.

3.5. Printing and Exporting - Share

You can print a report or export (CSV/XML/json/text or any other format) from any list view by selecting the records you’d like to include, then hitting the Share button. You can then select the type of output you want. If you choose PDF you can also select a background.

Learn more about Reporting and Export Templates.

3.6. Cogwheel special functions

The cogwheel is a powerful and very useful tool in onCourse, as it can execute a range of complex tasks on groups of records that would otherwise take a while to achieve manually.

The cogwheel appears on most screens in onCourse, and the options that appear under it will largely be contextual to the screen you’re viewing. You can manually execute scripts, duplicate classes and courses, send messages to contacts, add or remove classes from your website and a lot more.

To use the cogwheel, highlight a record on the window you’re viewing, then click the cogwheel icon to see your options.

3.7. Record detail view

The onCourse record view appears once you open (double-click) on a record in a list view. It is how you edit things like contacts, courses, classes etc. and contains tab groups. Depending on the records you’re viewing, the information displayed and how its shown can vary a lot.

To see a record view, go to a window like classes and double-click on a record in the list view. The screenshot below shows you what to expect in a typical class record view, remembering this varies depending on what kind of window you are in. All windows are laid out similarly in onCourse, with sections to group related data and navigate inside the record.

But the class record view alone is not enough to get an idea of how these sections work, throughout this documentation, there are detailed explanations of what each record view section means, for example see the classes chapter to learn about class record view sections in detail, or see the tutors chapter to learn about tutor record view sections.

When you make changes to a record, you can click the Save button to save your changes. If you click Close or try to navigate away from the page while you have unsaved changes, you’ll be prompted whether you want to save or discard your changes. Click Discard Changes to close the window and delete the unsaved changes, or click Save to save your changes.

Editing Text Fields

Numerous text fields in onCourse, like the description fields you find in Classes or Courses for example, power what displays on your ish website. These rich text fields are versatile in that they will let you select one of three markup varieties to work with; rich text (based on Markdown), legacy (textile-based rich text markup used by onCourse in the past) and advanced (html), for when you just want onCourse to get out of your way and let you type things out in HTML.

The Rich Text mode has a built-in visual editor that makes it very easy for all users to enter content. You can use the Write view to enter pure markup, or use Preview to see the correct formatting while you type.

You can learn more about the different types of markup modes, particularly rich text and legacy modes, in our Markup chapter.

3.8. Open related records

The open related records icon will appear in various windows throughout onCourse and it does a couple of things, depending on where you find it.

When next to a field, clicking it will take you to the related record. Like in the example below, the icon next to the Invoice to field shows that it will take you to Brandon Benitez’s contact record.

When you see this icon next to a section heading, it will take you directly to that window in onCourse, but without filters applied.

3.9. Mandatory fields

If you try to save a record that contains an empty field that has been set as mandatory, the Save button will appear with an exclamation mark in it, and when clicked, will scroll you to the field in question so you can enter the data before moving on.

You will not be able to save and continue before adding valid data to the field.

3.10. Offcourse Error

If you try to navigate to a page in onCourse that doesn’t exist, you’ll see the below error window. Click the Dashboard link to go back to the dashboard.

3.11. Audit Logging

Audit logs are created when a record is created, edited, or deleted. When a script fails or an email key collision occurs, an audit log record is also created. You can find the Audit Logs window by typing 'Audit Logs' into the search on the Dashboard, or by clicking the question mark icon on a window in onCourse, then clicking 'View audit trail'.

The Audit Log list view window displays all entities edited or created by each onCourse user and the date and time of that action.

The advanced search function in Audit logs allows you to search for a particular type of log e.g. script failure or log from a particular user.

Double clicking on the audit log for a script failure or email key collision will provide additional information in 'message' field in the edit view. Edit, create or delete logs do not show any additional information in the edit view.

You can also access the audit logs for a particular record by using the 'find related' feature from any list view. For example, you can select a class and find the related audit logs for that one particular class, or from the user account record, all audit logs for one particular user.

Audit logs will, by default, stay in your system for 12 months.

4. Users and Authentication

4.1. Security Settings

You can access the Security window on the dashboard. Along with some standard security-related preferences, here you will find a full list of users with login access to your onCourse application and data, along with the different user roles you have defined within onCourse.

If you know the name of the record you’re looking for, type it into the Filter Items search at the top of the left-hand column. Otherwise just scroll the list until you find what you’re after.

The first section is called 'Settings', containing onCourse’s main security related preferences, including rules around enforcing two-factor authentication. You have the following preferences to switch on or off:

- Automatically disable inactive user accounts

-

This will disable accounts that haven’t logged in after a set number of days. This could be useful for disabling the accounts of past employees if you don’t have the time to manage it yourself.

- Require better passwords

-

When enabled, this feature demands the use of a more secure password. When enabled, it will typically reject any common passwords and enforce a higher standard of password to be used by all users.

- Require password change every <x> days

-

When enabled, this feature will demand users change their password every set number of days. You can change the number of days manually by clicking the number in the field.

- Require two-factor authentication every <x> hours

-

When enabled, this will require all users to get a new authorisation via a third-party authorisation app after the set number of hours. You can change the number of hours manually by editing the number in the field. This only applies when the same user is using the computer. If another user signs in to their account on your computer, you will be required to enter your 2FA authorisation regardless of this setting.

- Disable account after <x> login attempts

-

When enabled, any user account that fails to login with the correct password this number of times will have their account disabled. An admin user of your system will need to go in to their user record and re-enable them manually. The default setting is 5 attempts.

4.2. Users

In user records you can add to or edit existing users details such as their name, email address, access level or send a password reset request. Only users with admin rights will be able to see, edit, and add users. Everyone else can only edit their own user settings. There are no limits to the number of users you can create in onCourse. Users should be deactivated if they leave your organisation.

Every person in the organisation who uses onCourse should have their own user account. We do not recommend users 'share' a login as various user layout preferences are saved against each user account. Important records created in onCourse like invoices, payments and enrolments are linked to the user who created them. If you need to follow up any discrepancies, this is made much easier when your staff each have their own user.

-

Name - A name for the user record. This isn’t used to login with, this is just an identifier.

-

First Name - The user’s first name

-

Last Name - The user’s last name

-

Email - the users primary email address, also used for login (this email address will be used for the CMS login process).

-

Bank cash/cheques to site - This should be the physical site where your staff are working. Select the site from the drop down menu. This is important if you take physical cash, cheque or EFTPOS payments at these venues and you need the site banking process to correctly tally the location balances.

-

Active - selecting this allows the user to login to onCourse. If active is not selected, the user will receive an "authentication failed" message at the onCourse login screen.

-

Admin - Checking this will allow the user to be an admin, they will have full access rights and can assign roles and rights to other users.

-

Last logged in - not editable, just tells you when that user last logged into onCourse.

-

Can edit CMS - this is a special permission that allows this user to login to your website via the CMS URL and make changes to the website pages directly. You do not need this permission to edit website content like courses, classes and products via onCourse.

-

2FA status - displays whether this user has two-factor authentication enabled or not.

Creating new users

In the left-hand column in the Security window, click the + button next to the Users heading to create a new user.

When creating a new user, the 'Save' button will read as 'Invite' and, when clicked, will send out an email to the new user asking them to click the link to accept the invitation to become an onCourse user. The user record will appear in the user list with a 'Invited' pill icon next to their name.

The new user will not be able to login until they have accepted the invitation. If there are issues with the invitation not being received, the 'Save' button will appear as a 'Resend Invite' allowing you to resend the invitation as many times as required.

Resetting passwords

if a user requires their password to be reset, an admin user can 'reset' a user’s password by clicking the 'Reset Password' button inside the user record. The user will be sent an invite to change their password. This invite is only active for 24 hours and will need to be resent if it expires.

If a user has this sent to them, then their current password will be immediately reset and they will not be able to log in until they have set a new password.

The Save button changes to Resend Invite and the user gets a small invite icon appearing next to their name in the user list.

|

If your College has more than one Administration Centre, it is possible to switch between these centres whilst a user is logged in via the Users section on the Security window. Simply select the user from the list on the left, and select a choice from under the 'bank cash/cheques to site' heading. |

Require password change every <x> days

An administrator can request a user change their password at their next login by hitting the 'require password change' button under 'Users'.

Require better passwords

If you have this setting enabled, the application will demand a better quality of password from your users, rejecting simple passwords e.g. a sequence of numbers or anything containing the word 'password'. If a user logs in and their password is deemed insecure, they will see a pop up prompting them to create a new one.

Preventing users from logging in twice concurrently

If you try to log into onCourse with the same login credentials as a user that is already logged in, then a window will pop up asking you what you want to do. You will then have the option to quit your login attempt, or log in and kick the other user using the same log in details out. So to prevent this from happening it’s best to always have your own user account.

4.3. User Roles

Access rights restrict what parts of onCourse users can modify, print, view or delete. This is an advanced feature, available for onCourse "Professional and Enterprise" customers.

Four pre-defined user roles are available within the system, Enrolment Officer, Administration Manager, Course Manager and Financial Manager. You can modify these and create new access rights groups as needed. Each user within your organisation can be given Admin access rights (full access) or be added to any of your access groups. Select the access rights when creating or editing user profiles, as above.

Creating and Editing User Roles

To access User Roles, in onCourse go to File > Preferences > Security, then look under the User Roles heading in the left-hand panel.

Here you can create roles for users, such as "Administration Manager." Some default access roles have been created in onCourse however you should edit these and create roles applicable to your own organisation.

Each onCourse user should be assigned to a user role that defines their access levels, by default all new users created will have full admin access to all aspects of onCourse.

You can edit an existing user role by clicking on its heading in the left-hand panel, or create new access roles using the + button next to the User Roles heading in the left-hand panel.

Icon Definitions

-

Orange circle - This is the level of access enabled for this entity.

-

Orange circle with a padlock - This access level cannot be edited. This may be due to choices you’ve made in other areas around types of access, or more likely, we’ve recognised it as a level of access that should remain locked for technical purposes. i.e. you cannot ever delete enrolments, you can only cancel them, hence this access remains locked at all times.

-

Two dots connected by light orange lines - These are default access selections

-

Two dots connected by bold orange line - These were set by a user

User Role levels of access

-

Hide: Some processes only have one level of access - allow. If this option is not ticked, it means the ability to run the process is denied and the element is hidden from use.

-

View: A view permission only allows the contact to see data already created, but does not allow existing records to be edited or new records to be created.

-

Print: Allows printing of reports associated with this record type

-

Edit:Allows both edit and view rights.

-

Create: Allows the creation of new records, edit and view rights.

-

Delete:Allows record deletion where permitted by onCourse validation. Linked and locked records can not be deleted just because a user has delete rights.

What can you edit in User Roles?

- Name

-

here you define the name of the role, e.g; "Administration Manager".

- People and companies

-

-

Contact: this refers to all onCourse students, tutors and companies. Full create rights are recommended for any user who needs to process enrolments as new contacts are often created at this time.

-

- Course Management

-

-

Course: Permission to work with courses

-

VET course details: This only relates to adding or removing unit of competency details from a course

-

Class: Permission to work with classes

-

Enrolment outcomes: Only edit rights are editable. This allows the user to set outcome results or change the outcomes linked to a student’s record

-

Budget: Viewing the class budget can be disabled

-

Session: This permission relates to sessions as they belong to classes

-

Waiting list: Permission to work with all wait list records

-

- VET Management

-

-

Qualification reference data: The only permission available here is edit, allowing you to add your choice of nominal hours.

-

Certificate: This relates to VET Statements of Attainment and Qualifications only. All contacts with class print permissions can create non-vocational certificates of attendance.

-

Print certificate without verified USI: This allows VET certificates to be printed when the student has a USI on record that has not yet been verified. A warning to the user will still be shown. This only applies to certificates created after 1/1/2015

-

Print certificate without USI: This allows VET certificates to be printed when the student has no USI on record. A warning to the user will still be shown. This only applies to certificates created after 1/1/2015

-

- Resources

-

-

Site: View cannot be disabled, allows user to create new and edit current Sites.

-

Room: View cannot be disabled, allows user to create new and edit current Rooms.

-

- Financial

-

-

Enrolment: Create permission needed for an onCourse user to use Checkout

-

Custom enrolment discount: Allow permission gives the ability for any manual discount to be added to any enrolment processed through Checkout.

-

Applications: Lets the user access course applications from prospective students.

-

Discount: This permission relates to the creation of discount strategies. Discounts will auto apply to any applicable enrolment regardless of permission here. Also the ability to link discounts to classes, corporate passes, concession types, and membership types.

-

Tutor roles: These roles determine pay rates for teaching staff.

-

Tutor pay: This permission relates to the creation and editing of payslips.

-

Override tutor session payable time: Allows user to unlock and modify a tutor’s payable time manually

-

Bulk confirm tutor wages: Allows users to click the 'confirm now' button in the Generate tutor payroll sheet that confirms all the unconfirmed pay lines

-

Invoice: This permission relates to the creation of manual invoices (invoices not created as part of the Checkout process).

-

Credit note: Allows the creation of manual credit notes. This permission is not needed for the creation of automatic credit notes during enrolment or class cancellation.

-

Payment In: Permission relates only to manual payment in records, not those created during Checkout.

-

Payment Out: This permission is about creating refunds, usually processed in real time back to payer’s credit cards.

-

Payment Method: This allows the user to change the payment method when accepting payments.

-

Account: Account settings for onCourse chart of accounts

-

Transaction: General ledger transaction records created during all financial transactions. These can only be viewed, never edited or manually created.

-

Financial preferences: The onCourse preferences that set the default accounts for various transaction types

-

Banking: Allow permission to run the bank process

-

Reconciliation: Allow permission to reconcile payments

-

Corporate pass: Permissions relating to the creation or editing or CorporatePass. This permission is not required to process a website enrolment that uses a CorporatePass for payment.

-

Payment plan: Permissions relating to the creation or editing Payment plans.

-

Summary extracts: Permission that allows a user to export/print MYOB Export and Trial Balance from the Financial menu.

-

- Special actions

-

-

Class duplication/rollover: Allow duplication of one or more classes from existing class(es)

-

Class cancellation: Cancellation process that prevents further enrolments and creates credit notes for existing enrolments

-

Exporting to XML: Export of class information for brochure production

-

Creating certificate from class: Bulk certificate creation process for VET and non-VET enrolments

-

Contact merging: Merge duplicate student records

-

Enrolment cancellation and transferring: Cancel or transfer individual enrolments and create a credit note

-

Export AVETMISS: Export training data for government reporting

-

Data import: Import data into onCourse

-

Override tutor pay rate: Allow a local override at the class level to any manually set pay rate

-

Edit/Delete Notes: Gives permission to edit and delete record note items

-

- Messaging

-

-

Email up to 50 contacts: This permission is useful for admin staff who may need to notify a class of students about changes at a time.

-

Email over 50 contacts: This permission is most appropriate to marketing staff who need to bulk email a large amounts of students at the same time.

-

SMS up to 50 contacts: This permission is for admin staff who may need to notify a class of students about changes.

-

SMS over 50 contacts: This permission is most appropriate to marketing staff who need to bulk SMS a large amount of students at the same time.

-

- Web and content management

-

-

Documents: Permissions relating to documents used on the public website, inside onCourse and available via the portal

-

Private Documents: Permissions relating to documents set as Private within onCourse. Can only view, edit and create. Cannot delete or print.

-

Tag: Permission relating to all tag groups, including those that drive the website navigation. This permission is not required to add tags to records, only to edit tag groups.

-

- Products

-

-

Product: This permission relates to the creation and editing of Products

-

Memberships: This permission relates to the creation and editing of Memberships

-

Vouchers: This permission relates to the creation and editing of Vouchers

-

Sales: This permission relates to the creation and editing of Sales

-

- Other

-

-

Report: Permissions to view, modify and print reports.

-

Email Template: Permission to modify Email Templates.

-

Export Template: Permission to modify Export Templates.

-

Scripts: Permission to modify Scripts.

-

Audit logging: Allows user to access Audit Logs

-

Contact relation types: Permissions to view/modify contact types.

-

General preferences: Relates to onCourse application preferences that affects all users

-

Change administration centre: Allows user to change administration centre details

-

Concession type: Permission to modify available concessions. This permission is not needed to add concession types to contact records.

-

Require two factor authentication: If this is allowed then a user who logs in without two factor authentication enabled is immediately shown the "Enable two factor authentication" dialog

-

4.4. onCourse Login with Two Factor Authentication

Two factor authentication (2FA) is an added layer of security for users accessing onCourse cloud instances, in particular, but also useful for locally hosted onCourse servers with VPN access enabled.

At every login attempt you will be encouraged to enable 2FA, and only once it has been enabled will this warning stop. This can be ignored by clicking 'Maybe Later'.

2FA means that there are two 'secrets' a user needs to know to successfully log in to your onCourse application. One secret is the password set for the user account. The second 'secret' is a code that requires a device such as a smart phone with a TOTP (time-based one time password) application such as Google Authenticator installed, with an account linked to the onCourse user account. This service generates a unique code every 30 seconds. To login successfully you will need both the user password and a current token.

When 2FA is enabled, after initial login there is a third field that asks for the 6 digit code provided by your TOTP application. If you try to log in with the wrong Token or Password, then you will get an error message saying 'Authentication failed' and you should get an admin user to disable 2FA in order to regain access to your account. You can re-enable 2FA once you’ve regained access.

Enabling two factor authentication

To enable 2FA, simply click 'Enable' when prompted at the login window.

Have your mobile phone handy while you do this as you will need to install the TOTP software as the first part of the process. Search for 'Google Authenticator' in your phone’s app store and install it.

When you first run the Authenticator app and click 'Begin setup' you may also be asked to install a QR code reader if you don’t already have one. You do not have to do this, as you can choose to manually add an account by selecting 'Enter provided key', however there is less chance of data entry error if you scan the code.

The account name you create in Google Authenticator can be anything you like, such as "My onCourse login". It does not have to match the name of your onCourse user.

You will be shown a six-digit code hat will change every 30 seconds. Enter this code into the authentication code field in onCourse and click Login.

Disabling or resetting two-factor authentication

If a user has two-factor authentication enabled and they wish to disable it, in the Security preferences click on the User’s account name, then click 'Disable 2FA'.

A window will appear confirming you definitely want to disable this feature and explaining how to re-enable it. To confirm, click on the 'Disable' button.

You should follow this process if you have bought a new smart phone and need to set up Google Authenticator again.

An admin user has the power to disable a users two-factor authentication if they have forgotten their mobile phone. You can do this by going to the Security window, double-clicking on the user you want to change, then clicking on the 'Disable 2FA'.

|

Only the user can enable their own two-factor authentication. |

An admin user can see a list of all users that have this feature enabled in the Security window by looking at the User accounts listed under 'Users'. Any user with 2FA enabled will have a small icon appear next to their name.

4.5. Emergency access

If you’re running your own onCourse server and run into issues where you no longer have access, you can create a .txt file to put into the server folder.

The file should be called createAdminUsers.txt and use the following format:

John,Doe,johndoe@mail.com Jane,Doe,<janedoe@mail.com> John Smith johnsmith@mail.com Jane Smith <janesmith@mail.com>

If the user is a new user, then that user will be created and an email will be sent to them requesting that they set their password.

If you add to this file a user that already exists, when the file is read, that user’s password is automatically reset and they will be sent a reset password email allowing them to set a new one.

4.6. Controlling User Access (authorisation)

Setting up Active Directory (AD) authentication and authorisation.

The below example has been completed with Windows Server 2003 R2 SP2 and onCourse 1.7.13. onCourse has the ability to use an external LDAP/AD server for authentication and authorisation, what we mean by this is that you do not need to use the onCourse user and group database but you can use your already setup AD database. Firstly on your Windows Server 2003 Machine go to "My Computer" right click and select "Properties" and you will find the following screen.

Please take careful note of the "Full Computer Name" and the "Domain" as with this information you now have the building blocks for our configuration.

Now the next thing we need to get the LDAP/AD authentication working is either the Administrator password or, a user account which is a member of the Administrators group. This is because when a query happens on the AD server it is required to login first before it can do any searches on users. If your administrators want to lock it down further they are welcome to do so, we only need read access to all user and group objects in the AD as well as the passwords for all of those users. So now we enter "Active Directory Users and Computers" and create our user: and add it to the administrators group and remember your password!

Once you have substituted all of the settings as necessary press the "Test Connection" button to ensure that onCourse can bind to the LDAP server. Once that works, you can then go to the "Users" section of this configuration page and place "sAMAccountName" and (objectClass=user) for the search filter. Now test a user in your domain and see if it authenticates. If it works, congratulations you are now authenticating against your AD server!

AD Authorisation

Authorisation is the process of giving your users the correct rights when they are logged in, this has a direct relationship with the different roles you can setup or create within onCourse. If you wish to use your AD server to allocate roles to your users, complete the following:

At the top of your "Active Directory Users and Computers" create an "Organizational Unit" (OU) and call it "onCourse".

In that OU create security groups which reflect the names of the roles in onCourse. Say for example the roles which are build into onCourse (you can find this in the Security window in onCourse, under 'User Roles'):

-

Administration Manager

-

Course Manager

-

Enrolment Officer

-

Financial Manager

You can add or delete roles here as you wish, but a corresponding group must exist in AD for the authorisation/access rights to be allocated.

When you have created those groups in AD add the necessary users who belong to each group.

We can then turn it on the onCourse preferences under LDAP/Authorisation and Roles and set it up the same as the following picture:

5. Search

5.1. Introduction

onCourse has powerful tools for searching across every piece of data you have collected. You can search in lists, perform basic and advanced searches on any attribute of the data and use these searches to write scripts and reports. In this chapter we’ll start from the simplest tools and then show you the more advanced possibilities that onCourse allows.

5.2. Dashboard search

The main Dashboard has a search bar where you can type in almost any type of data from a record, including a name, course code, class code, even an invoice number, and it will be shown in the search results.

If you click on a search result, that record will open in a new window unleass you are searching for a contact. Clicking a contact record search result will open that contact in the contact insights panel. You can learn more about that in our contact insights section of our manual

|

This is not the same as the Search function in list views. |

5.3. List Views

Every list view has a search panel across the bottom where you can type out simple search terms, like a name or course code, or queries to search on certain parameters.

Typing into the search bar will retrieve all records that match your input across certain fields. For example, in the Contact list, the text you enter will be found in first name, last name and email address fields. Simple search terms will automatically wrap in quotes. You can also type more complex queries into this field using the Advanced Query Language.

5.4. Find related records

Find related records is one of the most powerful tools inside onCourse, let you quickly jump from window to window, finding records related to groups of other records. The function icon is located next to the advanced search in each list view in onCourse.

For example, to locate all the employers of all the students aged 18 to 25 in the last three months of VET programs to send the Employer Satisfaction Survey to you can start by searching for all classes with a particular tag or use the advanced search on VET course flag. Once you have those classes, you can highlight those delivered in the last three months, and select from the find related icon 'Enrolled students'.

Once the student list has opened, you can search that list of results for students aged 18 to 25. The list view that has opened is in a special mode called 'custom selection' which you can see in the window header bar. This means other searches or filters you run on this window are only inside the special set of results you have created as a list.

With the reduced list of students, you can use the find related icon to select contacts related as an employer. From this new window, you can use the cog wheel to send a message to the student’s employers.

|

Find related can only be run on a max of 1000 records at any one time |

5.5. Advanced Query Language (AQL)

You can construct more powerful search queries using the onCourse query language. When clicked on, you’ll notice the search bar expands and shows numerous options for you to select from a drop down box. These selections are used to construct queries, which can be used to find either simple or complex sets of data. It might seem intimidating at first, but understanding the logic of this feature will help hone in on finding exactly the right data you need, and using the drop down boxes takes a lot of the guesswork out of this.

The small bookmark icon shows you whether or not your search query is valid. When the search is empty it appears grey, when you’re using an accepted query it’ll display in green, and when using an invalid query it’ll display in red. When the query is good and the bookmark is green, you can click the bookmark icon to save your search. On saving it, the filter will appear in the left-hand column under 'Custom Filters'. Just choose if you want it visible for only you or everyone who uses your system, give it a name then hit the save icon that appears next to it.

You can also use AQL in some sub-lists, like when adding a set of classes to discounts, or when adding a Corporate Pass to a voucher type.

A simple query consists of a field, followed by an operator, followed by a value:

title starts with "Apply"

In the above example, the field is 'title', the operator is 'starts with', and the value is 'Apply'. Searches are context sensitive to the screen you are viewing e.g. in the Unit of Competency list, this query will show you records beginning with 'Apply'.

Two or more queries can be linked together with conditional operators.

title starts with 'Apply' and nationalCode starts with "B"

In this example, 'and' is the conditional operator that combines the two separate queries. In this case, using 'and' means only records that satisfy both queries are returned.

Fields

When you click into the search box, a drop-down list of available fields will appear. The fields that are available to use in queries will change depending on which record type you are searching on. You can also search for custom fields by typing the custom field key associated with the custom field you want to call.

Operators

In your query, you will want to compare the field with some value. The type of comparison is defined with an operator. Each operator can be written as a word in full or as the short symbol.

- EQUALS or =

-

Finds records where the field matches the value exactly. This operator is not case-sensitive.

createdOn = today

nationalCode EQUALS "ABC"

- NOT EQUAL or !=

-

NOT EQUAL finds records that do not match the input value.

deliveryMode != ONLINE

- LESS THAN or <

-

LESS THAN returns records where the value is less than the input value.

LESS THAN can also be used with EQUALS to return records where the value is less than or equal to the input value.

enrolmentCount < 10

enrolmentCount <= 9

- GREATER THAN or >

-

GREATER THAN returns records where the value is greater than the input value.

GREATER THAN can be used with EQUALS to return records where the value is greater than or equal to the input value.

age > 17

age >= 18

- BETWEEN or ..

-

BETWEEN ( .. ) is used to specify a date range. BETWEEN ( .. ) will return records where the specified attribute occurred or was created between the set dates.

createdOn in 01/01/2018 .. 01/02/2018

BETWEEN can be used with a star closure ( * ), placed either directly before or after the date. See below for the correct syntax; placing the star and BETWEEN before the date will find all relevant data from before that date, while placing them after will find all relevant data after that date.

createdOn not * .. 01/01/2018

Both the above and below queries will show you the same data, all records created after 01/01/2018. The top query asks all records created before this date to be excluded thanks to the 'Not' operator, while the bottom query asks for all records created after this date to be shown thanks to the 'In' operator.

createdOn in 01/01/2018 .. *

- IN

-

IN will display any data that fits into the input data set.

A set is denoted as a list of items, where each element of the set is separated by a comma. In the below example, this query will return and display any data that has a confirmationStatus as either NOT_SENT or DO_NOT_SEND.

confirmationStatus in (NOT_SENT, DO_NOT_SEND) enrolment.student.id in (10,11,12)

- [ ]

-

Square brackets are a shorthand to search for the record id (the primary key in the database) in a list, denoted by [ ].

enrolment.student[10,11,12]

This query is equivalent to:

enrolment.student.id in (10,11,12)

- { }

-

Curly brackets allow you to reference a record attribute multiple times without needing to retype the full path to that attribute.

The following query can be simplified using curly brackets:

outcome.enrolment.status == REFUNDED and outcome.enrolment.student.contact.lastName == 'Smith'

Here’s the simplified version:

outcome.enrolment{status == REFUNDED and student.contact.lastName == 'Smith'}Notice how the path from 'outcome' to the 'enrolment' attribute is only typed out once. The query inside the curly braces is in the scope of the 'enrolment' attribute.

- BEFORE

-

BEFORE can be used in conjunction with dates (or date-specific keywords, like 'today' or 'tomorrow') to return any requested data created or set before the input date.

createdOn before today

- AFTER

-

AFTER can be used in conjunction with dates (or date-specific keywords, like 'today' or 'tomorrow') to return any requested data created or set after the input date.

createdOn after today

- CONTAINS

-

CONTAINS returns any data where the specified field contains/matches the input.

name contains "Gardening"

- STARTS WITH

-

STARTS WITH returns any data where the specified field contains data that starts with the input.

name starts with "Cooking"

- ENDS WITH

-

ENDS WITH returns any data where the specified field contains data that ends with the input. Note: this cannot be used in richtext fields

name ends with "Expert"

- NOT

-

NOT reverses the returned value of all of the previous operators.

For example, 'code not contains "Gardening"' with return all courses that have a code that does not contain the term 'Gardening'

name not like John

name not contains "Gardening"

name not starts with "Cooking"

name not ends with "Beginners"

- HASHTAG or #

-

The HASHTAG ( # ) operator will return records that are tagged with the specified tag in onCourse E.G. if you have a tag named Health and Care, and another named Training, and you wanted to find records that use either tag, you’d use:

#Health_and_Care or #Training

- FILTER TAG or @

-

The FILTER TAG ( @ ) operator is used to as shorthand to call a custom query or other filter that has been saved.

For example, imagine the following query is saved with the name kids:

Age <= 12

@kids can then be called in the construction of other queries

@kids and isMale is true

is equivalent to Age < = 12 and isMale is true

- LIKE or ~

-

The LIKE (~) operator is used to search a field for a specific pattern.

There are two special wild card characters used with the LIKE operator:

-

%: the percent sign is used to represent any amount of characters (including zero)

-

_: the underscore is used to represent exactly one character

Examples of the LIKE operator with wild card characters:

name ~ "a%" name like "a%"

finds any record that has a name starting with "a"

name ~ "%a"

finds any record that has a name ending with "a"

name ~ "%ab%"

finds any record that has a name containing "ab"

name ~ "_a%"

finds any record that has a name with "a" as the second letter

name ~ "_%_%_%"

finds any record that has a name with at least a length of 3 characters

name ~ "a%b"

finds any record that has a name starting with "a" and ending with "b".

-

Combining queries

- OR

name contains "Gardening" or code starts with "GAR"

- AND

startDateTime = tomorrow and successAndQueuedEnrolments >= minimumPlaces

- ( )

-

Use brackets to specify the order in which query fragments are executed.

name contains "Gardening" or (code starts with "GAR" and startDateTime = tomorrow)

Keywords

In onCourse, a keyword is a reserved word that has a predefined meaning.

- DATES

-

- today

-

the current day from 00:00 to 23:59

- yesterday

-

yesterday from 00:00 to 23:59

- tomorrow

-

tomorrow from 00:00 to 23:59

- last year

-

from January 1 00:00 to December 31 23:59 of the previous year

- last month

-

from the 1st of the previous month 00:00, to the last day of the previous month 23:59

- last week

-

from Monday 00:00 to Sunday 23:59 of the previous week. If 'today' is Thursday 13 September 2018, then 'last week' will be from Monday 3 September 2018 to 9 September 2018.

- next year

-

from January 1 00:00 to December 31 23:59 of the next year

- next month

-

from the 1st of the next month 00:00 , to the last day of the next month 23:59

- next week

-

from Monday 00:00 to Sunday 23:59 of the next week. If 'today' is Thursday 13 September 2018, then 'next week' will be from Monday 17 September 2018 to 24 September 2018.

createdOn today createdOn yesterday .. tomorrow startDateTime last week endDateTime next year

Dates can be combined with basic arithmetic and a specified time unit to query over a period of time.

createdOn today + 1 day createdOn yesterday..tomorrow + 2 week createdOn * .. today + 6 month createdOn 9:00 .. 19:00 today - 1 year

- ME

-

ME allows for search to be constructed using the currently logged in user as a query value.

Invoice.createdByUser = me

- RELATIVE TIME

-

Time references allow you to query for records within specific time periods

- now

-

acts as a timestamp for the moment the query is run

- <x> hour

-

set a number of hours to/from the search query period

- <x> minute

-

set a number of minutes to/from the search query period

endDateTime in now + 1 hour .. now + 2 hours 30 minutes

- EMPTY

-

The Empty keyword allows you to search for null fields. A null field is a field that contains no data. For example if you were in the classes window and wanted to find all the classes with no tutor, you could type/select the below in the search query field:

tutorRoles is empty

Arithmetic

Basic arithmetic can be performed directly within the query language. Addition, subtraction, division, multiplication and modulus operations are all supported.

feeHelpAmount is 100 + 50 feeHelpAmount is 100 - 50 feeHelpAmount is 100 / 2 feeHelpAmount is 100 * 5 feeHelpAmount is 100 % 3

Special attributes

Some record types have special attributes which aren’t stored in the database, but calculated on the fly. Some examples are:

- enrolmentCount

-

Search Class records on the current count of active enrolments.

enrolmentCount = 3

- isMinEnrolments

-

Search Class records to find those that have reached their minimum or above.

isMinEnrolments = true

- isMaxEnrolments

-

Search Class records to find those that have reached their maximum capacity.

isMaxEnrolments = false

Saving custom searches

Any search query that you create in the advanced search bar can be saved for just yourself to use, or for everyone who uses your onCourse system.

The small bookmark icon shows you whether or not your search query is valid. When the search is empty it appears grey, when you’re using an accepted query it’ll display in green, and when using an invalid query it’ll display in red. When the query is good and the bookmark is green, you can click the bookmark to save your search so it appears in the left-hand column. Just choose if you want it visible for only you or everyone who uses your system, give it a name then hit the save icon that appears next to it.

5.6. Searching in custom scripts

Scripts often need retrieve records from your database to perform some function. For example, if you wanted to contact all students who are enrolled in a class starting tomorrow, you would need to retrieve all classes that start tomorrow from the database.

Add a query panel to your script like this.

The results of this query are then available to you in your script in the variable 'records'. You can use this to perform additional actions in the script.

Read more information on custom scripts here in our scripts chapter.

6. Kiosk Mode for Sites and Rooms

6.1. Kiosk Mode for Sites

The onCourse kiosk mode is designed to show on a monitor or tablet the classes that are running at a particular site or room today. A large screen in a foyer or tablet outside each room is an inexpensive way to always show up to date information to tutors and students.

Clicking on the TV icon in the top right-hand corner of the 'Sites' edit view will generate a URL that looks like 'https://www.mycollege.com.au/site/kiosk/111' where www.mycollege.com is the URL in your general preferences College Website URL and 111 is the unique site ID.

Once you have clicked on the link to open the URL and can confirm it is displaying as expected, enter this into your display device. Once you have set the URL it will update itself regularly to show current information at all times.

The data shown in kiosk mode will be the real time data of today’s classes that are either in progress, or yet to commence. The data is sorted by start time order, and then alphabetically. As classes complete, they automatically drop off the list.

When there are no classes scheduled for the day, or all the day’s classes are complete, both the site and/or room kiosk view will display "There are no more classes scheduled for today."

6.2. Kiosk Mode for Rooms

A kiosk view is also available for each room of a site, to display the classes running today. This is the URL you would access if you wish to display the details for all classes scheduled in a particular room, for example, to display on a tablet located near the room’s door.

Click on the TV icon in the top right-hand corner of the 'Room' edit view to access the URL for that room. The URL will be your college site appended with something like /room/kiosk/469 where "469" is the onCourse unique ID for the room.

Like the kiosk view for a site, the room view will only show classes in progress and scheduled for today. As the class session completes, it will drop off the list automatically.

6.3. Customising the kiosk

You can customise the design of the kiosk in three ways:

Adding a logo

Log into your website webDAV interface (see the design handbook for details) and put your logo at the path /kiosk/img/logo.png. This will place your logo in the top left corner of the kiosk.

Adding your own styles

Put a css file at '/kiosk/css/kiosk-local.css' and override any of the default styles with your own.

Changing the html

The kiosk is just another tml file like all other parts of your site, so you can make more radical changes by changing the kiosk pages and components through webDAV.

You can learn more about using WebDAV here: https://www.ish.com.au/onCourse/doc/design/#_editing_your_site_via_webdav

7. Preferences

The Preferences screen is where you set up the basic administration functions of onCourse, providing the area for initial set up. Any changes made to any parameters on this screen need to be saved by hitting the 'Save' button in the top right or the window.

It’s also where your Data Collection Forms, Data Collection Rules, and Tutor Pay Roles are defined. You can learn more about those specific functions by viewing the Data Collection chapter or the Payroll chapter.

Click on the (?) in the window header to open the onCourse manual, or to view the audit trail. The audit trail allows you to view a record of changes to records in your system at any one time.

You can find specific sub-sections within this window by using the Filter items search at the top of the left-hand column.

- College

-

The college preferences allows you to input your organisations name, ABN and website URL.

- Licences

-

The licences preferences are an important part as it displays what kind of features your organisation have available (depending on which support plan you have)

- Messaging

-

The messaging preferences allows you to set preferences for mail.

- Class Defaults

-

These preferences allow you to set the defaults for minimum and maximum number of places, the delivery mode and funding source of a Class.

- LDAP

-

Stands for Light Directory Access Protocol and allows users to be authenticated by either LDAP or AD (Active Directory). If you don’t know what this is, then you definitely don’t need it.

- Maintenance

-

The maintenance preferences allows you to set backup preferences and change whether you would like automatic logout on or not.

- AVETMISS

-

Stands for the Australian Vocational Education and Training Management Information Statistical Standard which is the national reporting standard for Australian Registered Training Organisations, it is essential that these fields are all filled out fully and correctly as it is a major part of AVETMISS reporting.

- Financial

-

The Financial preferences is where you set such things as what currency and local tax that is being used, amongst what default accounts to use.

- Funding Contracts

-

onCourse has created default templates for the state-based funding contracts, and integrated them with your AVETMISS reporting options. You are able to create custom funding contracts for any source of funding that supports the student enrolment, and enable/disable default funding contracts.

- Grading types

-

This is where you can create or edit the grading types used for scoring assessment submissions.

- Holidays

-

These preferences allow you to add Holidays (unavailabilities) for your whole business timetable and scheduling availability.

- Payment types

-

The payment types preferences allows you to define what payment methods you want to use.

- Tax types

-

The Tax types preferences allows you to define the Tax options you can use.

- Concession types

-

This is where you can define what concession types your students are able to use.

- Contact relation types

-

The contact relation types preferences allows you to define what relationships you want to be able to link contacts together with.

- Sellable items relation types

-

The types of relationships you can set between courses and products.

- Custom fields

-

This is where you can add any new custom fields you want to appear in contacts records, along with the option to add them to the online Enrolment, Waiting List and Application questions.

7.1. Setting your General Preferences

To access the Preferences window in onCourse, from the Dashboard type 'Preferences' into the dashboard search bar.

College

Once you’re in the Preferences window, click on the College option to see the College preferences.

|

Entry fields coloured red are the only places that need information entered in order to activate onCourse. Not coloured fields do not require any data to be entered; they are optional, and the onCourse system will run smoothly if they are not filled in. The red will go away once you have entered your information correctly and pressed enter. If the box does not change from red then you will need to review your information and try entering again. |

-

On the Services tab, Enter the College Name e.g. Rosewood College. This is a required field and you will not be able to proceed with the set up process without first entering a college name.

-

To the right enter the ABN e.g 18 123 456 789

-

Now enter the College Website URL e.g. rosewoodcollege.com.au

-

The default server timezone will be set to Australia/Sydney. If you are in another timezone, please set it accordingly. This will affect when your automated scripts will run, as the cron time set for various scripts are referencing your server time zone.

Licences

The licences preferences tab shows you what onCourse features are enabled or are inactive. Features available here will match the level of onCourse plan your college is on. If there are features in onCourse you’d like access to but currently do not, get in touch with us to ask about upgrading your plan.

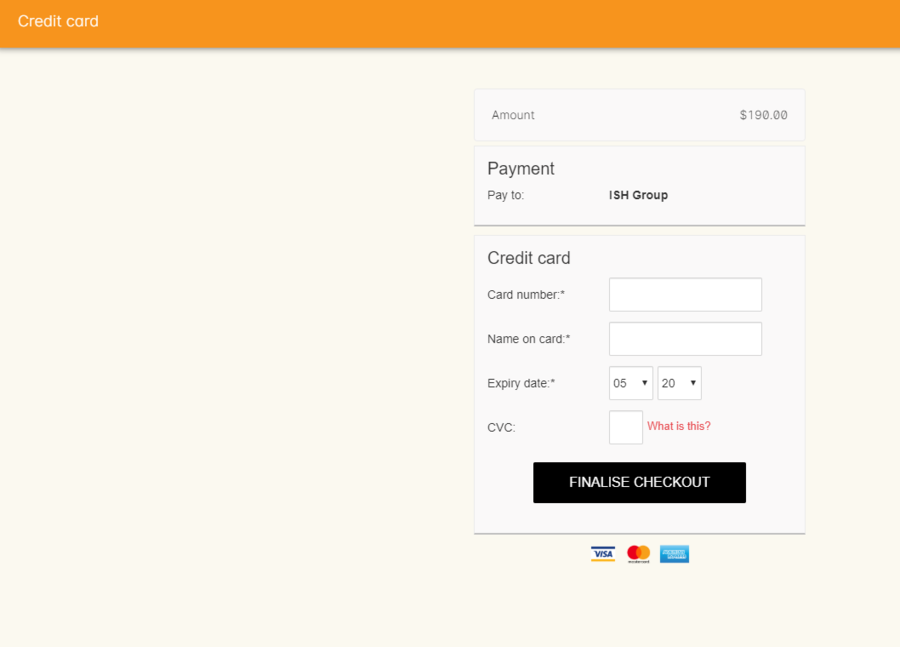

Linking your credit card merchant ID

In order to use the onCourse integrated credit card gateway you need to contact ish with your merchant details from your bank. ish will be able to then link your account to onCourse and provide a quick way to take payments both in the office, and your onCourse powered website.

-

You’ll need to determine with your bank/acquirer whether your new or existing merchant account supports and has “auth” transaction types enabled.

-

Contact ish on 02 9550 5501 or email sales@ish.com.au if you have any further questions or need assistance with this process.

Messaging

onCourse makes it easy to send emails and SMS to the students and teachers that are listed on your contacts list. In order to do this you first need to configure the onCourse message settings.

-

In the 'Email from name' field enter the address from which you want contacts to see that emails are sent from. i.e. info@rosewoodcollege.com.au

-

The System Administrator Email Address is the address that undeliverable mail and bounces will go to (if you don’t use VERP). You will need a valid email account that will be accepted by that mail server. You should contact your mail administrator to verify that these details are correct.

-

Underneath is the emails queued notification. This field will notify you of how many emails are in the queue waiting to be sent. Say you are sending out a bulk email to prospective students to remind them of the start date of the new term, the number in this field will tell you how many emails have yet to be sent, i.e. how many remain in the queue.

Emails that are unable to be sent due to mail configuration errors will stay in the mail queue rather than be marked as failed on the sending attempt. You cannot enter any data into this field.

Handing bounced emails (VERP)

VERP - Variable Envelope Return Paths is a feature which automatically handles bounced emails from onCourse. When this is enabled, emails are sent out with a special From address that looks like "bounces+124673@rosewoodcollege.com.au".

The Reply-To address is set normally with the standard from address you have defined in "Email from address", so a user can reply without any problems. The number after the plus sign is used to identify the Contact in onCourse to whom this email was originally sent: this is important because emails could be forwarded several times in remote mail systems, and the bounce may not come from the address you expect.

This "plus addressing" notation is a standard internet protocol and most mail servers support it. You simply define the base email account (e.g. "bounces@rosewoodcollege.com.au") and the mail server will ignore the part after the plus.

-

If you wish to activate this function then tick the option, detect and process bounced emails.

-

Enter the incoming mail server address (POP3) then enter the email address to where the bounced emails are sent e.g. bounces@rosewoodcollege.com.au.

-

Enter the account name followed by the account password. This will be used to retrieve mail from that account by POP.

The SMS box enables you to send texts. You may want to text students a reminder for the new term start date or for a change of venue or contact tutors about their hours or pay.

|

Make sure to use a short text name in the 'SMS From' field. Do not use a phone number. |

You can send bulk texts direct from the onCourse program. What you enter into the SMS from field is what the receivers of your SMS messages will see as the sender details. Make sure this is text-only. Phone numbers entered into this field are commonly rejected by the SMS provider platform.

Class Defaults

The Class Defaults tab allows the user to set the defaults for minimum and maximum places in a given Class, as well as the delivery mode and funding source.

Note that these defaults can be manually overridden at the individual Class level.

LDAP

LDAP - stands for Light Directory Access Protocol and allows users to be authenticated by either LDAP or AD (Active Directory), tying your onCourse user accounts and log ins to the account and login details your staff use to access other IT resources on your network. This is a feature that is enabled as part of a purchased onCourse support plan. Contact us if you need help setting this up, it’s generally something for your sysadmin.

Maintenance